Building trust and growth

Technology development has disrupted the way bank doing its business. It changes the approach for marketing and user experience through digital banking. Especially in marketing, social media has been replacing the role of marketing staff; thus, a financial institution should invest more on the technology and interactive service innovation (Dootson et al., 2016).

Together with Finastra, Jenius starts the digital banking era. Jenius is a digital platform from BTPN Indonesia; one of the public banks in Indonesia. BTPN is 40% owned by Sumitomo Mitsui Banking Corp and ranked in top ten banks in Indonesia by total assets. Therefore, Jenius is a trustworthy entity on saving and investing money.

In 2016, they introduced a Jenius with a revolutionary idea of online bank account registration. It just needs an uploaded ID Card and a selfie photo with the ID. However, recently they went further by launching a service account activation through video-call. There are also several innovations on Jenius’s business model, which are:

- Building reliable and secure apps

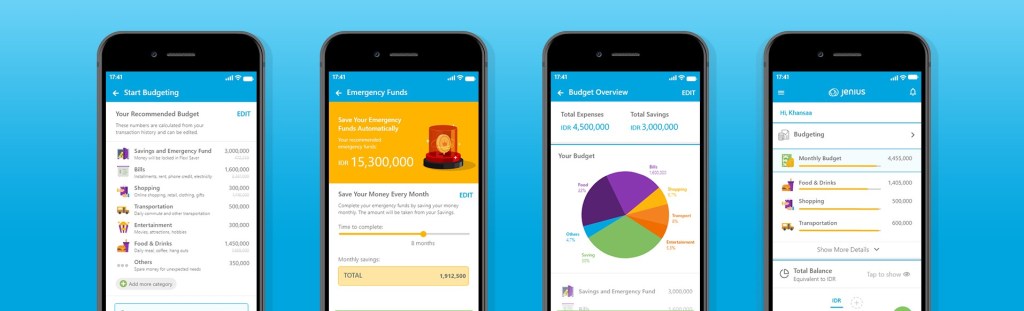

Jenius is one of the leading apps with more than 2 million active users (CNBC, 2019). They spend more than US$35,8 mil on research and development to create Jenius apps. The feature is distinct from the competitor. It is more to improve and simplifies the user experience through mobile technology. It can boost up connectivity and big data analytic to get predictive user’s needs that will crucial for innovation in the future. According to McKinsey (2014), it is estimated that 30 billion devices will be connected in 2020; thus, the apps could exhibit valuable data for business analytic in the future.

2. Moving service to the apps

Jenius is offering many services such as mortgage, loan and exchange currency. The customer can directly access these services from their phone, and the application will be processed automatically. Besides moving to an online statement, Jenius also provide better personal experience by engaging in customer’s daily lives. A slick budgeting tools and ability to split the budget between investment and consumption to help users to put a concern more about financial planning.

3. Partnership with e-Wallet and e-Commerce

Jenius also make a partnership with e-Wallet providers in regards to supporting economic growth. e-Wallet role becomes vital since it already uses by small and middle enterprise to replace cash as for payment. According to McKinsey (2018), the digital level of the banked population starts to rise with 32% digitally active and 26% in moderate activity level. It is coherent with digital payment methods which dominated by 72% as a form of payment in social media (Paypal, 2017)

Retrieved from https://giladiskon-uploads.s3-ap-southeast-1.amazonaws.com/images/deals/jenius-promo-aktivasi-promo-giladiskon-637024961457509980.jpg

High Tech, Low Cost

Advanced technologies allow the bank to study customer behaviour and suggest to them what they need. It can significantly cut the cost of marketing and provides Jenius with a competitive benefit over their less tech-savvy competitor. One of the core competencies is its transparency which can create trust between the bank and the customer. BTPN is not exactly a big bank player in Indonesia, but with Jenius as their “weapon” which host bunch of features will engage the user on a deeper level. It can gradually change user’s behaviour at a fundamental level such as how to shop, banking and socialise.

Jenius implement the disruptive strategy by providing a radical, low cost but “sufficient” alternative which starting at the bottom of the trends. They disrupt how people do banking in Indonesia. Digital natives are part of a tech-savvy generation which identical with the needs of connected. It ranges from how they socialise, shopping, and banking. Jenius give them numerous service such as the freedom to use any exchange currency when they travel and become the only one Indonesian bank which already provides contactless payment. Therefore, tourist and business people do not need carrying cash when they travel around the world. It is coherent with the digital lifestyle which identical with simplicity and vast networking.

Retrieved from https://youtu.be/rBPtzvdxeAI

Is Jenius’s business model will sustainable?

According to investor.id (2019), Jenius has contributed around 5% for the third-party funds of BTPN. It indicates people start to put trust in this digital banking and BTPN is in the right track by putting more effort into Jenius.

Being the first player in digital banking, Jenius always challenged by the lack of infrastructure and conventional mindset. With 42% of the non-digital population in Indonesia, digital banking and e-commerce can work together to decrease the number. According to Statista (2019), there is US$32.442m digital payment just from e-commerce and Point of Sale Payment and is estimated to rise to US$38.016m in 2020. Therefore, there is an opportunity to develop further and make cashless society and online transaction as a lifestyle in the future. Jenius already has a good start by being the Best Digital Bank Indonesia in 2018.

Word Count : 796

Reference

Dootson, P., Beatson, A., & Drennan, J. (2016). Financial institutions using social media–do consumers perceive value?. International Journal of Bank Marketing, 34(1), 9-36. Retrieved from https://www.emerald.com/insight/content/doi/10.1108/IJBM-06-2014-0079/full/html#idm46319890696160

Hasibuan, L (2019, November 8). Top! Nasabah Jenius Sudah Tembus 2 Juta. Retrieved February 28, 2020, https://www.cnbcindonesia.com/market/20191108110455-17-113678/top-nasabah-jenius-sudah-tembus-2-juta

https://www.btpn.com/en/berita-media/ulasan khusus?content=5608&active=archive&page=1

McKinsey. (August 15, 2018). Distribution of the banked population in Indonesia in 2017, by digitizing level [Graph]. In Statista. Retrieved March 01, 2020, from https://www.statista.com/statistics/970822/indonesia-digital-level-of-the-banked-population/

McKinsey’s Frankfurt office. (n.d.). The Internet of Things: Sizing up the opportunity. Retrieved February 29, 2020 from https://www.mckinsey.com/industries/semiconductors/our-insights/the-internet-of-things-sizing-up-the-opportunity

Nieuwenhuizen, Peterjan v (2017, January) Case Study: Launching Jenius: a New Digital Bank in Indonesia, Retrieved 28 February, 2020 from https://www.finastra.com/sites/default/files/2018-02/Success-Btpn-Launching-Jenius_0.pdf

PayPal. (November 19, 2017). Payment acceptance by merchants on social media in Indonesia in 2017, by type [Graph]. In Statista. Retrieved March 01, 2020, from https://www.statista.com/statistics/896260/indonesia-accepted-payment-methods-on-social-media/

Sahara, N (2019, August 26). Aplikasi Jenius Berkontribusi 5% ke DPK BTPN. Retrieved February 28, 2020, from https://investor.id/finance/aplikasi-jenius-berkontribusi-5-ke-dpk-btpn

Sari, Elisa V (2016, August 11) Bermodal Rp500 Miliar, BTPN Siap Bertarung di Bisnis Fintech. Retrieved February 28, 2020 from https://www.cnnindonesia.com/ekonomi/20160811180224-78-150789/bermodal-rp500-miliar-btpn-siap-bertarung-di-bisnis-fintech

Statista (2019) Digital Payments – Indonesia. (n.d.). Retrieved February 29, 2020, from https://www.statista.com/outlook/296/120/digital-payments/indonesia

Excellent post! The rise of the digital banking system is true and I can feel how digital banking affects our daily life. Another example here I would like to share is Monzo banking, which is very similar to Jenius. I registered it without going to bank by myself instead I was doing registration in my room and just upload identification number and recorded a video to prove you are not a robot. I use Monzo everyday especially when I went to travel with my friends. As you have mentioned in your post before that the high technology is a competitive advantage that allows s them to understand customers’ behaviour. However, I am concerned that this competitive advantage would be less important as if more and more banks are transforming into the digital banking system. Therefore, Jenius has to find a new way to be outstanding. What if most of the bank in Indonesia have realised the importance of digital banking system and start to transform into it. I would like to know what do you think that the Jenius should do? Should they keep providing more high-quality service? or implement the absolute cash-less system? In my point of view, I would say maybe they could use the tech of AI and combine it with the data they have collected to produce a personal money manager, which is absolutely interesting but challenging.

LikeLike

Thank you for the insight mate. Yes, Jenius definitely still have a lot off work to do in order to be competitive in the future. Especially, if a bigger bank tries to imitate what Jenius does; thus, Jenius should prepare on new radical innovation that can last-long. I think that Indonesia still not ready yet to implement what Monzo does. They still prefer cash transaction because it is more reliable and applicable. Jenius already take a leap on providing digital banking in Indonesia, and it will continue to innovate in regards to encourage people to convert to digital banking. Jenius can add some financial apps such as investment, saving account and financial planner within the apps. Implement the full scale of a cashless system would be difficult since Indonesia does not own the proper infrastructure to do it. However, it might have happened if the people of Indonesia already think digitally and think broadly about how digital transform our way of life. Using AI also is a “might be” issue, but every company is already run towards it. Therefore, Jenius should embrace it by giving the best services for the customer and they can collect the data to create behavioural of the customer.

LikeLike

Very nice narration on Jenius. As a user, I do agree that the Jenius concept of banking is a groundbreaking rules. What I do love more in the Jenius feature is that you can do foreign exchange from IDR into other currency. Although is still limited to some currency, but it still the first mobile app banking in Indonesia that can do such things, and I think it’s amazing. You also did highlight that one are that still have to improve is the conventional mindset. Do you have any idea to tackle that issue?

LikeLike

Thank you Fajar for sharing your thought

I think that Indonesia should start building infrastructure for National Cashless Movement. There is no other way beside changing all the payment form and force people to do cashless to achieve that program. So, it is just matter of time when people have to do digital banking and digital transaction because there is no another platform using cash anymore.

LikeLike

Thank you very much for sharing. Through your article, I can find that Junius Bank no longer depends on the services of offline banks. Digital technology does make it possible to do business that was once done in a physical bank but online at any time. I am very interested in the service you mentioned that people could exchange currency directly in the app. Because nowadays, before people go to another country, they have to go to the bank to exchange the currency and carry a lot of cash to that country. But this is undoubtedly dangerous and tedious. For security reasons, banks cannot implement this function online. But I believe that due to the continuous development of technology, Junius Bank will become a pioneer in this area and bring more convenience to people.

LikeLike

Nowadays, almost all traditional business have disrupted by digital technology, including banking. Branchless banking is a new trend which has many advantages than the conventional ones, for example, less cost since they don’t need opening physical bank. For customers, it is a more convenient way of opening an account with just a smartphone. But, the main issue with this branchless banking is about trust, which the conventional bank has most. In Jenius case, it is a coincidence that Jenius backed by the traditional bank, so the trust issue doesn’t be a problem. But, how about the new player who doesn’t have any support from conventional banking build its trust? What do you think?

LikeLike