Tax authorities embrace technology as one of the tools to do an enhance and thorough audit.

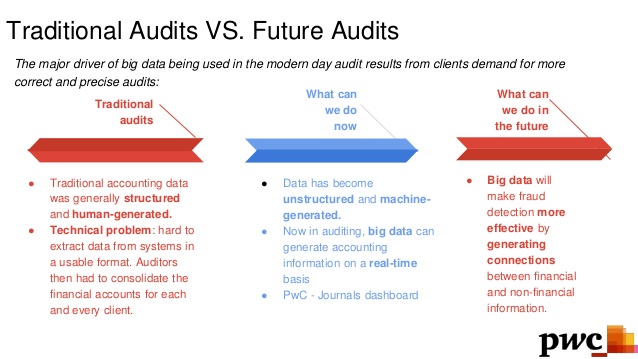

Coerced by shrinking revenue due to digital disruption, tax authorities now are heavily relying on the digital approach to obtain taxpayers data and compartmentalised by its significance (Global EY, 2019). Previously, data was generally human-generated and manually collected through the paper. It includes the invoice and financial reporting that become the source of the tax audit. These methods seem obsolete with upcoming trends of big data.

Big data is a term that been used for massive, raw and unprocessed data. This data needs to be analysed before it can be used for enhancing productivity and effectivity, in this case, gathering taxpayer’s data. Hence, tax authorities must have a robust data analytic procedure to produce unbiased and accountable results.

To focus on, I will talk about my previous job as a government tax auditor. As government tax auditor, my job is to conduct an audit of the taxpayer’s finance report to ensure compliance with tax regulation. In the past, doing an audit on businesses such as retail and manufacture will implicate tons of paper and invoice to verify whether it complies to tax regulation or not. It is exhausting and cost significant time not to mention doing back and forth validity check from multiple companies which doing business with their client. This process should be more efficient, considering how digital disruption has implicated how organisation and economy are functioning.

Digital disruptions have a massive implication on how businesses evolve, and it is confirmed with nine out of 20 top companies on the world market capitalisation are digital and not only ten years ago, only one is digital (Fortune, 2009). Digital business such as Amazon, Facebook, and Apple bring new challenges to government tax auditor regarding their aggressive tax planning. Doing tax audit on digital companies cannot just merely rely on a financial report, sales report, and benchmarking data.

Until now, the audit has focused on understanding the past. Today, drawing up data for audit purpose is primarily on general ledger data. Nevertheless, accepting big data to support the audit process by obtaining sub-ledger information which contains massive raw data that need to be analysed to get a forecast of the business. It can help tax auditor to predict how business developing and make a plan to prevent any aggressive tax planning that may occur in the future.

The audit process will go beyond sample-based testing to full analytics for the entire population using deep analytics methods which will enable us to identify fraud more precisely (Reporting EY, 2015). This kind of audit need an enhance skill that needs to be acquired by any government tax auditors; hence, the audit result will be excellent. It cannot be replaced by an engine or software that will sort it out the data and doing all the analysis. The software should amplify people and empowered them by technologies and collective intelligence not necessarily replace human.

The software should replace repetitive task with workflow automation and capable of doing simple data analytics (Moffitt & Vasarhelyi, 2018). Hence, tax auditor can prioritise developing advanced critical thinking and data analytics. To substitute a pile of paper of financial data, tax auditor can use blockchain to retrace any transaction that already done in the past. It can help with accuracy and validity since all have been digitalised. For tax purpose, it can start by compiling Country by Country Report (CbCR) which contains all of the operation of a multinational company in every country in the world. Organisation for Economic Co-operation and Development (OECD) as a supranational body which has concern for tax planning already encourage that every country should be sitting together to use CbCR data further to resolve the issue of aggressive tax planning. Otherwise, everybody will suffer.

Amplifying, not replacing

Establishing modern audit framework, including performing e-audit with specific tools to show anomalies based on real-time data will be the future. At first glance, this development may suggest declining needs of human tax auditor (Valk, 2020); however, highly trained tax auditor will become critical.

The role of government tax auditor will change over the year. It is the human experience that any Artificial Intelligence (AI) cannot replace. AI cannot quickly analyse business complexity with multiple tangible angles. Instead of presenting straight-forward data analytic from AI, tax auditor still needed for the ability to make the decision, human reason and draw a conclusion to build a case in a court of law.

Tax auditor has always evolved as the business changed and will continue to develop to tackle aggressive tax planning. Big data, AI, and blockchain is just a tool to help tax auditor to reach its potential. Tax auditor who proficient on computational, literation, data analytic will be at front row on tackling aggressive tax planning.

Word Count 791

Reference List

Bowker, A. B. (2018, July 28). How Data Analytics could Impact Auditing within PwC. Retrieved February 9, 2020, from https://www.slideshare.net/AlexanderBriscallBow/how-data-analytics-could-impact-auditing-within-pwc

Chartered Accountants Australia and New Zealand. (2016, March 28). What skills will an Auditor in the Future Need? Retrieved February 10, 2020, from https://www.youtube.com/watch?v=w_nQ6xE4PDM&feature=youtu.be

Fortune 500 2009: Fortune 1000 Companies 1-100. (n.d.). Retrieved February 9, 2020, from https://money.cnn.com/magazines/fortune/fortune500/2009/full_list/

Global, E. Y. (2019, May 27). How data analytics is transforming tax administration. Retrieved February, 9, 2020 from https://www.ey.com/en_gl/tax/how-data-analytics-is-transforming-tax-administration

Moffitt, K. C., Rozario, A. M., & Vasarhelyi, M. A. (2018). Robotic process automation for auditing. Journal of Emerging Technologies in Accounting, 15(1), 1-10. https://doi.org/10.2308/jeta-10589

PricewaterhouseCoopers, Global Top 100 Companies by market capitalisation. Retrieved February, 9, 2020, from https://www.pwc.com/gx/en/audit-services/publications/assets/global-top-100-companies-2019.pdf

Reporting, E. Y. (2015, April 1). How big data and analytics are transforming the audit. Retrieved February, 9, 2020 from https://www.ey.com/en_gl/assurance/how-big-data-and-analytics-are-transforming-the-audit

Valk, C. V. D. (2020, January 23). The shifting role of tax auditors in the digital age. Retrieved February 9, 2020, from https://www.accountancyage.com/2019/10/15/the-shifting-role-of-tax-auditors-in-the-digital-age/

Very interesting about big data which play a significant audit role in the future. On the other hand, I found that one of the problems that often occur is inaccurate data. In this blog, https://www.smartdatacollective.com/tax-authorities-may-use-big-data-audits/ Internal Revenue Service (IRS) found that many data is not valid because the taxpayer didn’t give the correct Social Security Number deliberately or unintentionally. So, the tax authorities have another job to match the data. How are the tax authorities tackling this problem?

LikeLike

Hi Andi

Thank you for the reference.

Well, nothing perfect mate. So that validation and data merge is a very critical step in the first analytic process. As a tax auditor, we have to make sure that audit data is reliable and valid. As I said before, big data is raw and massive data that need to declutter in order to function.

So the first step to solving the problem, the tax authority should design a well-build software to capture any misconduct primarily when the taxpayers input their Social Number. It should detect any abnormalities of the sequence or the format of social number; thus, the software would not accept the registry and ask the taxpayers to input the correct number.

Another choice is working together with the Social Security Administration (SSA) to validate the Social Security number. It can easily be done with entering the database from SSA to tax authority software and matching it. Hence, the problem would not occur when it does its job.

LikeLike

The post has adequately described the authorities of tax with the implication of advanced technologies. The pictorial representation of the traditional, as well as future auditing has been effectively used in the post with proper sources. The personal reflection of being a government auditor has been effective in enhancing the understating of a particular topic. The post at the same time talks into consideration of the negative approaches of using digital technologies in auditing services. The real company examples such as Amazon, Face book, as well as Apple, have been effective in maintaining the high quality of the post. The future prediction of the affective technological implication has been highlighted in the field of tax and auditing is done in a coherent manner. However, the more detailed information about the auditing by using digital technologies would have been beneficial for the effective understanding of the topic (Vinogradova et al., 2019). The overall explanation of the blockchain is effective in understanding the topic in a profound manner.

Reference list

Vinogradova, M., Konstantinov, V., Prasolov, V., Lukyanova, A. And Grebenkina, I., 2019. Level Entrepreneurship-Role In The Digital Economy, Tendencies Of Improvement Of The Information Support System. Journal of Entrepreneurship Education, 22(5), pp. 1-12.

LikeLike

Thank you for your insight. I hope in the future, people still in control of every decision rather than machine do it for us. Sadly, I cannot go into more detailed in just one article about how doing an audit using technologies. I’ll try to explain in the next post

Thank you

LikeLike

Thank you 😊

LikeLike

Hi Rifqi! Your post is really hopeful because I have a similar background with you, government officer at the tax agency, and hope that tax audit will be more efficient by tech. In addition to your discussion, if the technology enhances our ability on examination, how should the organization change? Will some tax examiner lose their job by AI? In my opinion, if we can recognize some risky transactions, a company that is suspected to be tax evasion or aggressive tax avoidance, our organization could concentrate resources on these risky targets. Where most company has already made correct tax return, the ordinary tax examination will be “in-efficient” in the future. On the other hand, the AI tools would accelerate our examination and increase the additional tax revenue from the other bad taxpayers. What do you think about the next strategy of the organization after changing by AI?

LikeLike

Hi Masato, really tough question mate

I think the organization should start to worry about how capable its human resources. If they do not perform well, then it likely there will be some people will lose their job. It all now depends on how the auditor increases their skill to keep up with the technology.

Well, as I said before, the AI will take over the repetitive jobs. It includes making a priority of tax cases. For instance, the AI will make a shortlist based on risk analysis of taxpayers compliance. Therefore, the auditor can deal with the highest risk that needs deep analytical skills that AI can cope with a human.

The most logical step of the tax authority in the near future is giving its auditor training on analytical skill and technologies. Thus, they will use the AI in an optimum capacity without worrying it will replace their jobs.

Thank you

LikeLike